Tax Blog Post Sample 3

Tax Preparartion"Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua....

Stressed about taxes and accounting? Get a high-quality professional so you can focus on what matters most. Growing your business!

Don’t hire someone to simply fill out your tax forms. Get a professional that understands accounting and can help you maneuver the tax code to save more.

Get your accounting done right the first time. Knowing your numbers monthly will help you to make better decisions and operate efficiently and effectively.

Stay compliant with government entities by filing correctly on time. Avoid IRS penalties by having a tax guru in your pocket that has experience dealing with state and federal tax agencies.

Get proactive with your taxes. The best time to save money on taxes is before the year ends. Our professionals can help you set up a plan to save as much as possible come tax season.

Let Us Provide You With FREE Tax Resources

Let’s face it: most tax laws are confusing at best. Let us provide you with free documents to help you understand some of the ins and outs of the tax code so that you can save as much as possible.

Get your accounting done right the first time. Knowing your numbers monthly will help you to make better decisions and operate efficiently and effectively.

Stay compliant with government entities by filing correctly on time. Avoid IRS penalties by having a tax guru in your pocket that has experience dealing with state and federal tax agencies.

Get proactive with your taxes. The best time to save money on taxes is before the year ends. Our professionals can help you set up a plan to save as much as possible come tax season.

Homemaker

Working with Casey was great! He is super knowledgeable and easy to work with. He explains everything extremely well and is very easy to understand. I know when we work with Casey everything is getting done correctly and he is getting us as many tax breaks as possible! I will definitely be using him again!”

Engineer

Casey’s awesome! I didn’t have to worry about our taxes at all this year. He even gave us extra tips to help us in future years with our personal returns and our business!”

See what our clients say about our services!-

Update Chad’s job to Salesman-

Update Savannah’s job to Sales Manager-

At Tax Launch, we pride ourselves on delivering tailored solutions that help our clients achieve their financial goals. Our case studies showcase real-world examples of how we’ve helped individuals and businesses navigate complex accounting and tax challenges with clarity and confidence.

Taxes are an inevitable part of life, and addressing them effectively each year can save time, money, and stress.

Falling behind on tax returns happens more often than you’d think. Life has a way of throwing unexpected challenges at us, and taxes often take a backseat.

Monthly bookkeeping and accounting are vital for any business. It’s not just about preparing for tax season at the end of the year—it’s about maintaining a clear picture of your business’s financial health throughout the year.

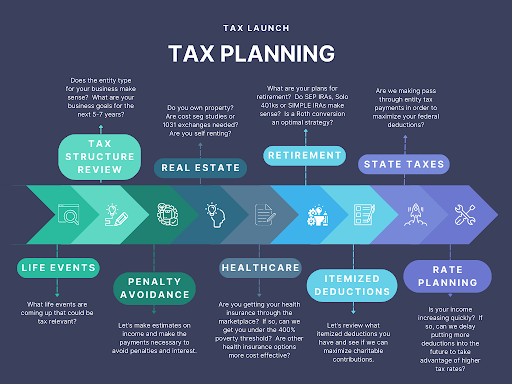

The term “tax planning” often lacks a clear and universal definition within the CPA and tax planning industry. Many clients reach out asking for tax planning without fully understanding what it entails.

We provide value my assisting our clients in the preparation of financial statements, tax planning and tax preparation.

We provide bookkeeping, tax preparation, tax planning and sales tax preparation services.

Tax Launch does not currently specialize in any industry. Our goal to to help small and medium-sized business owner alleviate stress and maximize savings related to accounting and taxes. We have experience in a varietyof industries including restaurant, auto body repair, real estate etc.

We have a running dialogue with our bookkeeping clients which includes a monthly review of the balance sheet and profit and loss statements.

Our tax clients we typically reach out in November to discuss potential tax planning needs and then again at the end of January or beginning of February in order to get the ball rolling on tax preparation services

You’ll need income statements, expense records, W-2s or 1099s, and any additional relevant documentation like charitable contributions or investment records.

Yes, we handle audits and government correspondence. The most common situation we have is receiving a document from the IRS or state tax agency stating that tax is owed for some reason. We have tons of experience in calling the IRS and handling those types of situations trying to resolve these issues in your favor.

For monthly bookkeeping, we typically offer a flat fee that is based on the time we think it will take to complete the project.

Tax and other engagements are based on time spent on a project. Our typical business tax engagement costs between $750-$1,500 and our typical personal tax return engagement costs between $400-$750

Yes, we can help you register a new business. We charge our hourly rates for this work. We only register new businesses in Utah however and not in other states.

Yes as your business grows your relationship with your accountant will become more and more important. We love watching our business owner’s be successful and we want to continue to help you grow your business.

Now is the time to sit down and review your tax situation. Set up a free consultation today.

Tax Preparartion"Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua....

Tax Preparartion"Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua....

caseybringhurstcpa@tax-launch.com

(385) 231-6476